See This Report about Offshore Company Formation

Table of ContentsSome Known Facts About Offshore Company Formation.Offshore Company Formation Can Be Fun For EveryoneThe Main Principles Of Offshore Company Formation Offshore Company Formation Fundamentals ExplainedMore About Offshore Company FormationOffshore Company Formation Things To Know Before You Buy

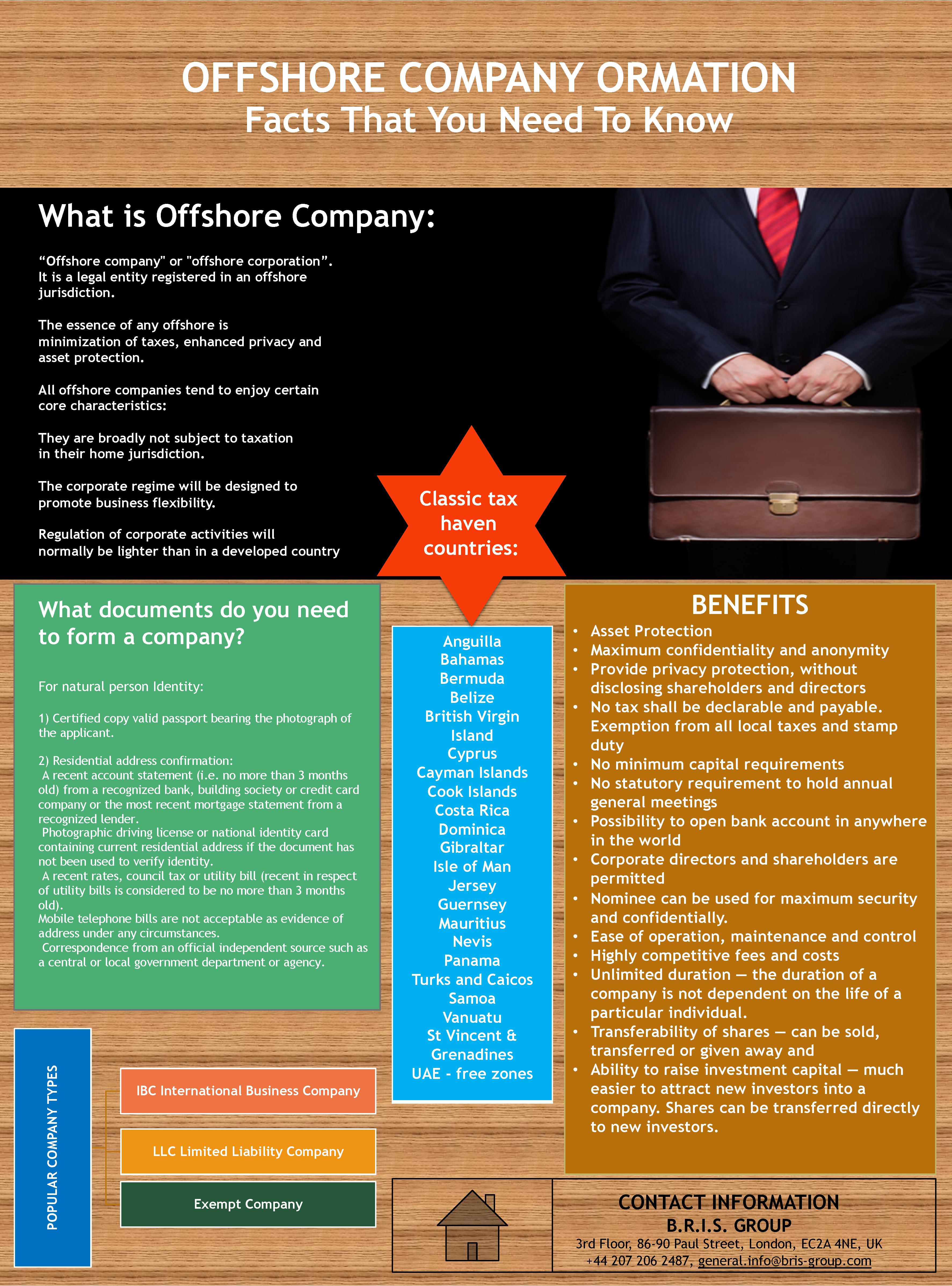

Although tax obligation performance is the major advantage, proprietors could additionally profit from lowered organization expenditures. There are frequently fewer legal obligations of managers of an overseas business. You can additionally decide to have virtual office services that are both economical and also they additionally conserve time. It is also typically simple to establish up an offshore business and also the process is easier compared to having an onshore business in several components of the world.There are various other jurisdictions that do not call for funding when registering the company. An overseas business can work well for several groups of people. If you are a businessman, for instance, you can develop an overseas company for discretion functions and also for convenience of administration. An offshore company can additionally be utilized to accomplish a working as a consultant company.

An Unbiased View of Offshore Company Formation

Actually, the procedure can take just 15 minutes. Also prior to developing an overseas company, it is initially important to recognize why you choose overseas firm development to setting up an onshore firm. Do not established up an overseas business for the wrong factors like tax evasion and also money laundering.

If your main go for opening an overseas firm is for privacy purposes, you can hide your names utilizing nominee services. With candidate solutions, an additional person uses up your duty and also indicators files on your behalf. This indicates that your identity will certainly continue to be exclusive. There are numerous points that you should remember when picking an offshore territory.

Offshore Company Formation Fundamentals Explained

There are fairly a number of overseas jurisdictions and also the entire job of coming up with the best one can be fairly made complex. There are a number of points that you also have to put right into factor to consider when picking an offshore territory.

If you established an overseas business in Hong Kong, you can trade worldwide without paying any kind of local tax obligations; the only problem is that you ought to not have an income from Hong Kong. There are no tax obligations on funding gains as well as investment earnings. The area is likewise politically and also financially steady. offshore company formation.

With so several territories to select from, you can always locate the finest location to develop your overseas company. It is, however, crucial to site link take note of information when coming up with your option as not all business will enable click resources you to open for checking account as well as you need to guarantee you exercise proper tax obligation preparation for your local as well as the international territory.

The Single Strategy To Use For Offshore Company Formation

Corporate structuring and also preparation have achieved greater levels of intricacy than ever before while the requirement for anonymity remains solid. Companies must keep up as well as be frequently looking for new ways to make money. One means is to have a clear understanding of the attributes of offshore international firms, and how they may be propounded helpful usage.

A more right term to make use of would certainly be tax obligation mitigation or planning, since there are methods of mitigating tax obligations without damaging the law, whereas tax obligation evasion is generally identified as a crime. Yes, because a lot of nations motivate global trade as well as enterprise, so there are usually no limitations on locals operating or having bank accounts in other nations.

Not known Factual Statements About Offshore Company Formation

Advanced as well as respectable high-net-worth people and also companies regularly utilize offshore financial visit this page investment automobiles worldwide. Protecting properties in mix with a Count on, an offshore firm can stay clear of high levels of income, funding and death tax obligations that would otherwise be payable if the possessions were held directly. It can also safeguard assets from creditors and other interested celebrations.

If the firm shares are held by a Trust fund, the possession is legally vested in the trustee, hence gaining the possibility for even higher tax obligation preparation advantages. Family and Safety Trust funds (potentially as an alternative to a Will) for buildup of financial investment earnings and also lasting benefits for recipients on a beneficial tax basis (without income, inheritance or capital gains tax obligations); The sale or probate of residential or commercial properties in various nations can come to be complex as well as costly.

Conduct organization without corporate taxes - offshore company formation. Tax havens, such as British Virgin Islands, enable the formation of International Business that have no tax obligation or reporting duties. This means you save money not just from the lack of company taxes, however likewise from various other regulatory costs. Enable work or consultancy charges to gather in a low tax area.

The Ultimate Guide To Offshore Company Formation

This permits the fees to gather in a reduced tax obligation territory. International Companies have the exact same legal rights as an individual person as well as can make investments, deal actual estate, profession profiles of stocks and bonds, and also conduct any legal service activities as long as these are refrained from doing in the country of enrollment.